Are you looking for things to stop buying to save money? It can be tough to save money, especially when there are so many things that we need in our lives.

But it’s not impossible! In fact, by making a few small changes in the way that we spend our money, we can start to see a difference in our bank accounts.

One great way to save money is by cutting back on the things that we buy.

What Will Happen When You Stop Buying Things That You Don’t Need?

- You will have more money to spend on things that matter.

- Your budget will be easier to manage because you won’t have to worry about spending money on things you don’t need.

- You’ll be less likely to go into debt because you won’t have as much temptation to spend money on things you don’t need.

- You’ll be able to save more money for the things that are important to you.

24 Things To Stop Buying Immediately To Save Money

Here are 24 things that you can stop buying right now and start saving money!

Things To Stop Buying To Save Money #1. Cut the Cord

You can cut the cord and switch to streaming services like Netflix or Hulu instead. If you don’t want to give up live sports, consider signing up for a service like Sling TV which offers channels such as ESPN without having an expensive cable package.

You’ll save money every month by eliminating your monthly bill while still enjoying all your favorite shows!

Related – Thing to Rent Out for Profit

Things To Stop Buying To Save Money #2. Gym membership

If you’re not using it, don’t pay for one. Try working out at home or outside instead. You’ll save money and get fit without spending any extra cash on things like gas or equipment that might only be used once a week (if ever).

Plus, there are all sorts of free online workout videos available online so even if you can’t go to the gym every day, there’s still hope for those who want their exercise fix without breaking the bank!

Things To Stop Buying To Save Money #3. New clothes

Why buy something when you probably already have it?

Check your closet first before making an impulse purchase because chances are good that with just some minor alterations and cleaning up things will look brand spankin’ new again.

And if you’re in desperate need of something new, try thrift stores or clothes swaps with your friends to get what you need without spending a fortune.

Things To Stop Buying To Save Money #4. Eating out

This one can be tough because it’s so convenient to just order food instead of cooking, but the costs really add up over time!

Try prepping meals ahead of time or packing a lunch instead of relying on restaurants for all your meals.

You’ll be surprised at how much money you save by not eating out every day (or even every week).

Things To Stop Buying To Save Money #5. Bottled water

Stop buying those expensive bottles of water and invest in a reusable water bottle that you can fill up from the tap.

Not only will this save you money in the long run, but it’s also much better for the environment since plastic bottles take up so much space in landfills and oceans.

And if you’re worried about your tap water tasting gross, try adding lemon slices or cucumber slices to add some flavor without spending any extra cash!

Things To Stop Buying To Save Money #6. Expensive coffee and Lattes

Instead of getting that latte from Starbucks every morning (which can cost up to $12), make your own at home using things like milk, sugar and instant coffee grounds which are all really cheap. You’ll save money while still enjoying a delicious cup o’ joe first thing when waking up each day!

Things To Stop Buying To Save Money #7. Paper towels

There’s no need to buy these things anymore because they aren’t necessary–just use rags instead! They work just as well and you can reuse them over and over (just make sure to wash them in between uses).

Not only will you save money by not buying paper towels, but you’ll also be doing your part to reduce the amount of waste produced each year.

Things To Stop Buying To Save Money #8. New cars

This one is a biggie! Cars are expensive, and they depreciate in value as soon as you drive them off the lot. Try driving your current car for longer instead of trading it in for a newer model–you’ll save yourself a lot of money in the long run.

And if that’s not possible or desirable, consider buying a used car rather than a brand new one. You can still get something that’s reliable without spending tens of thousands of dollars.

Related – How to Save $10,000 in 6 Months

Things To Stop Buying To Save Money #9. Fast Food

You already know that fast food isn’t the best for your health, but did you realize how bad it is for your wallet? A $20 meal at a fast food restaurant can easily turn into a $50 one if you’re not careful.

Things To Stop Buying To Save Money #10. Cigarettes

Smoking is an expensive habit, and it’s also bad for your health. A pack-a-day smoker can expect to spend nearly $2000 per year on cigarettes. That’s a lot of money that could be saved by quitting!

Things To Stop Buying To Save Money #11. Alcohol

Drinking alcohol can be a fun way to let loose and relax, but it’s also an expensive habit. If you’re trying to save money, try limiting your alcohol consumption or choosing cheaper drinks like wine coolers or just drink water.

Things To Stop Buying To Save Money #12. Bank overdraft fees

This is a huge source of income for banks, and also a common way people end up in debt.

If you can’t always remember how much money you have left or are prone to spending things before they clear, it might be worth using an app like Mint that will tell you when things are about to bounce.

Things To Stop Buying To Save Money #13. Bank wire fees

This is another fee that you’ll be charged for by banks, so it might be worth looking into alternatives if possible.

You can try things like Paypal instead, which will let you send money to friends or family for free (depending on the country).

There are also other money transfer services like TransferWise that can help you save a lot of money on fees.

Related – How to Save $5,000 in 6 Months

Things To Stop Buying To Save Money #14. Extended warranty on products

This is something that a lot of people are suckered into, especially when it comes to electronics. The thing is, most things these days come with a warranty for at least one year, and if they don’t you can usually buy an extended warranty from the store.

So there’s really no need to spend extra money on things that already have warranties.

Things To Stop Buying To Save Money #15. Brand new things

If you’re looking to save money, it’s worth considering second-hand things as an alternative. This can be anything from clothes to furniture and even cars if you want!

The key here is just remembering that most things do depreciate in value as much as we think they do, so you’re not losing out on anything by buying things second-hand.

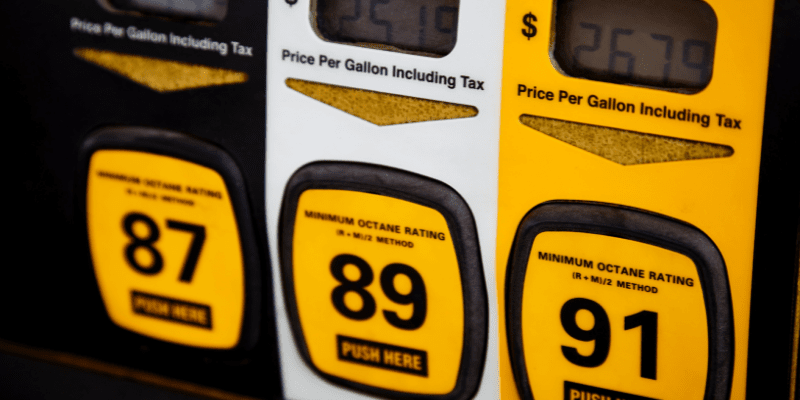

Things To Stop Buying To Save Money #16. Premium Gas

This is a big one for people who drive. There are things like premium gas that’s supposed to be better for your car, but in reality, it won’t make much of a difference at all.

You can save money by just filling up on cheaper gas instead and using the savings elsewhere!

Things To Stop Buying To Save Money #17. Expensive cell phone plans

This is another big one for a lot of people. Cell phone plans can be really expensive, and there are a lot of cheaper alternatives out there.

If you’re not locked into a contract, it might be worth looking at things like prepaid or month-to-month cell phone plans to save some money.

Things To Stop Buying To Save Money #18. Brand name prescriptions drugs

This is something that a lot of people don’t think about, but you can actually save money by buying generic prescriptions drugs. The thing is, they work just as well and are much cheaper.

You might have to ask your doctor if there’s a generic alternative for the prescription drug you’re taking, but it’s definitely worth looking into.

Things To Stop Buying To Save Money #19. Credit card interest

This is something that a lot of people don’t think about, but it can really add up!

If you have credit cards with high rates of interest on things like balance transfers or purchases then paying these things down as fast as possible will help save money overall in the long run.

Things To Stop Buying To Save Money #20. Losses on things like stocks or other investments

Some people are just prone to losing money when they invest in things, so it might be worth avoiding investing altogether if you’re one of these people.

Otherwise, though, there are things like mutual funds that can help diversify your portfolio and reduce risk overall.

Things To Stop Buying To Save Money #21. Late charge fees

This is another one that can easily be avoided.

Most things now have a grace period of at least a few days, so there’s no need to worry about late charge fees if you accidentally miss a payment.

Just make sure to set up automatic payments for things like your rent or credit card bills!

Things To Stop Buying To Save Money #22. Kick your Bad Habits to the curb

Bad habits like smoking, drinking alcohol or gambling can cost a lot of money over time. If you have any bad habits it might be worth trying to break them so that you save more money in the long run!

Things To Stop Buying To Save Money #23. Dryer sheets

Dryer sheets are a convenient way to add a little scent, softness, and static protection to your laundry. But you pay for the convenience: They cost about $0.50 per load!

Moreover, dryer sheets contain numerous chemical compounds that not only irritate potential skin allergies but also trigger respiratory illnesses as well.

And they can coat your dryer’s lint filter, causing it to trap less and potentially start a fire.

Instead of treating each load with a dryer sheet, switch to wool balls instead! Wool-dryer-balls work by bouncing around in the dryer and separating clothes so that hot air circulates more efficiently.

This not only saves time, but it also naturally softens clothes and reduces static cling.

I recommend wool balls over plastic ones because they are more durable and can last for years. They’re the ultimate green alternative to dryer sheets and they will save you money over time!

Things To Stop Buying To Save Money #24. Things you don’t need

Before making any purchase, ask yourself if you really need it. If the answer is no, then chances are good that you should save your money and not buy it.

This can be tough in today’s society where things like “keeping up with the Joneses” are so common, but if you can learn to say no to things that aren’t necessary then you’ll be well on your way to saving money!

Related – Bad Money Habits Examples

Final Thoughts – 24 things to stop buying to save money

When it comes to saving money, one of the best things that you can do is stop buying things that you don’t need.

There are a lot of things that we purchase regularly without even thinking about it, and these purchases can really add up over time!

There are plenty of other things that you can stop buying right now in order to start saving money, but these are a few of the most important ones.

So take a moment to evaluate your spending habits and see where there might be some room for improvement–you could end up saving a lot of money in the long run!

Frequently Asked Questions

What should you not do to save money?

To save money effectively, it’s important to avoid certain common pitfalls and unhealthy financial behaviors. Here are some things you should not do to save money:

- Ignoring a Budget:

- Neglecting to create and follow a budget can lead to overspending and financial disarray. Having a budget helps you track your income, expenses, and savings goals, providing a clear roadmap for your financial decisions.

- Impulse Spending:

- Making impulsive purchases can quickly erode your savings. Before buying non-essential items, take the time to consider whether they align with your financial goals and whether you can truly afford them.

- Neglecting Emergency Savings:

- Avoiding the creation of an emergency fund can leave you vulnerable to unexpected expenses. Without a financial safety net, you may be forced to rely on credit cards or loans, potentially leading to debt accumulation.

- Misusing Credit Cards:

- Relying heavily on credit cards and carrying a balance can result in high-interest payments and long-term debt. Strive to pay your credit card balances in full each month to avoid accumulating unnecessary interest charges.

- Failing to Negotiate:

- Whether it’s negotiating bills, interest rates, or prices, failing to negotiate can mean missing out on potential savings. Take the initiative to negotiate better deals on services, interest rates, or purchases whenever possible.

- Not Investing in Your Future:

- Neglecting long-term investments, such as retirement accounts or other wealth-building strategies, can hinder your financial growth. Start investing early and regularly to take advantage of compounding returns.

- Ignoring Financial Education:

- Not investing time in learning about personal finance can lead to poor financial decisions. Stay informed about basic financial principles, investment strategies, and money management to make informed choices.

- Living Beyond Your Means:

- Continually spending more than you earn can lead to a cycle of debt and financial stress. Adjust your lifestyle to match your income and focus on building a sustainable financial foundation.

By avoiding these common mistakes, you can build a stronger financial foundation and work towards achieving your savings goals.

How do I stop buying expensive things?

Stopping yourself from buying expensive things often involves a combination of mindset shifts, behavioral changes, and practical strategies. Here are some tips to help you curb the impulse to purchase expensive items:

- Establish Clear Financial Goals:

- Define specific short-term and long-term financial goals. Knowing what you’re working towards can help you prioritize spending and resist unnecessary purchases.

- Create a Budget:

- Develop a realistic budget that outlines your income, necessary expenses, and savings goals. Allocate a specific amount for discretionary spending, and stick to it.

- Identify Wants vs. Needs:

- Distinguish between essential needs and non-essential wants. Before making a purchase, ask yourself if it’s a necessity or if it aligns with your financial goals.

- Practice Delayed Gratification:

- Implement a waiting period before making significant purchases. This allows you to reconsider the necessity of the item and prevents impulsive buying.

- Use Cash or Debit Cards:

- Paying with cash or a debit card rather than credit can make you more aware of your spending and help prevent the accumulation of debt.

- Unsubscribe from Retail Emails:

- Reduce temptation by unsubscribing from promotional emails and newsletters from retailers. This minimizes exposure to sales and discounts that might trigger impulsive buying.

- Create a Shopping List:

- Before entering a store or browsing online, create a list of items you need. Stick to the list to avoid making unplanned, expensive purchases.

- Implement the 24-Hour Rule:

- For non-essential purchases, wait 24 hours before deciding to buy. This gives you time to reflect on whether the item is a necessity or just a fleeting desire.

- Visualize Your Goals:

- Keep reminders of your financial goals visible. This can be a visual representation, such as a vision board or written goals, to reinforce the importance of saving over spending.

- Find Affordable Alternatives:

- Explore more budget-friendly alternatives or consider buying second-hand. You might find that there are lower-cost options that meet your needs.

- Practice Mindfulness:

- Be mindful of your spending habits. Regularly assess your financial decisions and their impact on your overall financial well-being.

- Seek Support:

- Share your financial goals with a friend or family member who can help hold you accountable. Having a support system can make it easier to stay on track.

Remember that changing spending habits takes time and consistency. Celebrate small victories and be patient with yourself as you work towards more mindful and intentional spending.

Over to you

Have you ever stopped buying any things to save money? Please share your comments below.

Latest Articles

- Why is Personal Finance Dependent Upon Your Behavior?

- Hosting an Online Garage Sale: Go from Clutter to Cash now

- 11+Cheap(or Free) things to do in retirement: Do more with less!

- Coast FIRE: Path to Financial Independence with Less Sacrifice

- Cash Stuffing Method: The Ultimate Financial Hack You Need to Know