Are you looking for a way to get out of debt and save money? If so, you may want to consider the no spend challenge guide. This is a challenge that asks participants to refrain from spending any money for a specific period of time.

In this guide, we will discuss the ins and outs of the no spend challenge, including tips on how to stick with it!

Pin it! 😎

What Is A No-Spend Challenge

The no-spend challenge is a way to get out of debt and save money. The goal is to refrain from spending any money for a specific period of time. This challenge can last for a week, a month, or even longer.

How To Stick With It

There are a few ways to stick with the no spend challenge:

- Make a list of things you need and want. This will help you to focus on what is important and avoid impulse purchases.

- Find free or low-cost activities to do. This will help to keep you from getting bored and tempted to spend money.

- Stay motivated by setting a goal. This could be saving a certain amount of money or paying off debt. Having a goal will help you stay focused and motivated.

How It Works

The no-spend challenge works by asking participants to refrain from spending any money for a specific period of time. This could be for a week, a month, or even longer. During the challenge, you will need to find ways to get by without spending any money.

This may be difficult at first, but it is possible.

Learning To Do A No-Spend Challenge By Yourself

The first step is admitting that you have a spending problem. If you’re not sure whether or not you have a problem, take some time to track your spending for a month.

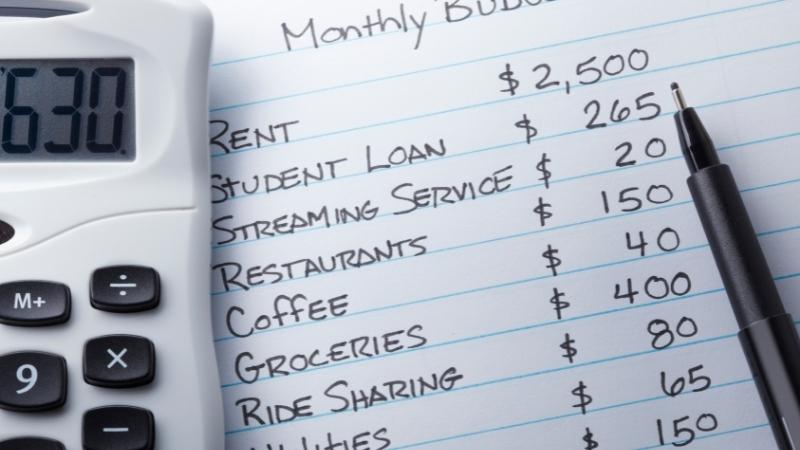

Track Your Spending

Write down everything you spend, including groceries, bills, and entertainment. Once you have a good idea of where your money goes each month, compare it to your income. If your spending is more than what you bring in, then you have a problem with overspending.

Set Some Parameters

If you’re confident that you can do a no-spend challenge on your own, then the next step is to set some parameters. Decide how long you’re going to do the challenge for and what you’re going to allow yourself to spend money on.

For example, you may want to allow yourself to spend money on groceries and bills but nothing else.

Once you have your parameters set, it’s time to start the challenge! For the first few days, you may find it difficult to stick to your plan. This is normal! Just keep reminding yourself of your goals and why you’re doing the challenge in the first place.

Still Struggling?

If you find that you’re struggling after a week or two, there are a few things you can do to get back on track. First, take a look at your parameters and see if there’s anything you can change.

Allow For Some Wiggle Room

Maybe you’re not allowing yourself enough wiggle room or maybe you need to be more strict with yourself. If you’re finding it difficult to stick to the challenge, try lengthening the timeframe or cutting back on the number of allowable expenses.

Reach out to A friend or Join An Online Community

Another thing you can do is reach out to a friend or family member who is also interested in saving money. Having someone to talk to about the challenge can help you stay motivated and on track.

You can also join an online community of people doing the same challenge. This can be a great way to get support and advice from people who are in the same boat as you.

Making The No Spend Challenge Easier

If the idea of doing a no-spend challenge on your own seems daunting, don’t worry! There are plenty of ways to make the challenge easier on yourself.

One option is to do a spending freeze instead of a no-spend challenge. With a spending freeze, you still allow yourself to spend money on essentials like groceries and bills, but you stop all other forms of spending.

Another option is to find someone who wants to do the challenge with you. This can make the challenge more fun and less daunting. You can also set parameters together and offer each other support.

If you’re looking for an even easier way to do the challenge, there are a few apps and websites that can help. These tools allow you to track your spending and find ways to save money.

Some of them even have built-in budgets so you don’t have to worry about creating one yourself. I recommend using Pocket Smith.

Here are a few tips on how to make the most of the challenge:

The no spend challenge guide #1. Stay disciplined

It is important to stick to the challenge and not give in to temptation. If you allow yourself to spend money whenever you want, the challenge will be much harder to complete.

The no spend challenge guide #2. Set Goals

Set a goal for yourself. Figure out how much money you want to save or how much debt you want to pay off during the challenge. This will help you stay motivated throughout the challenge.

The no spend challenge guide #3. Make an Expense List

Make a list of all the expenses you can cut out during the challenge. This may include things like eating out, buying groceries, and going to the movies.

The no spend challenge guide #4. Be Creative

Find creative ways to have fun without spending money. Try exploring your city or town, hanging out with friends, or reading books for entertainment.

Other creative ways to save money include couponing, price matching, or using cash back apps.

The no spend challenge guide #5. Stay positive

It can be tough to stick with the no spend challenge, but remember that the goal is to improve your financial situation! Be proud of yourself for every accomplishment and don’t let any setbacks get you down.

The no spend challenge guide #6. Avoid Temptations

The best way to avoid temptation is to not have the money available in the first place. This means no credit cards, no debit cards, and no temptation to spend. If you can’t physically see the money, you’re less likely to spend it.

The no spend challenge guide #7. Create a Budget

Creating a budget is the best way to keep track of your spending and make sure that you’re not overspending on unnecessary things.

By knowing how much money you have available each month, you’ll be able to better allocate your funds and make sure that you’re not spending more than you can afford.

More Reading – Tips to Be Financially Successful

The no spend challenge guide #8. Set Financial Goals

Setting financial goals is a great way to stay motivated and on track with your spending. Having a goal in mind will help you focus on the things that are important to you and help you avoid unnecessary purchases.

More Reading – Things to Stop Buying to Save Money

The no spend challenge guide #9. Create a Savings Plan

A savings plan is the best way to ensure that you’re able to save money each month. By setting aside a fixed amount of money each month, you’ll be able to gradually build up your savings over time.

This will help you cover unexpected expenses in the future or provide a cushion in case of tough financial times.

The no spend challenge guide #10. Start Today

The sooner you start the No Spend Challenge, the sooner you’ll see the results. So what are you waiting for? Start today and watch your savings grow!

The no spend challenge guide #11. Plan Ahead

One of the best ways to stick to the No Spend Challenge is to plan ahead. By knowing what you’re going to do each day, you’ll be less likely to give in to temptation and spend money unnecessarily.

The no spend challenge guide #12. Involve your Family and Friends

The more people that are involved in the No Spend Challenge, the better. This will help keep you accountable and make it easier to stay on track. Plus, it’s a great way to save money and get out of debt together!

The no spend challenge guide #13. Reward Yourself

It’s important to set goals along the way and reward yourself for your hard work. This will help keep you motivated and on track as you work towards your ultimate goal.

A few ideas for rewards include: taking a relaxing bath, buying yourself a new book, or going out to eat at your favorite restaurant.

What should I do with the money I save from the no spend month?

One of the best things about the No Spend Challenge is that you get to decide what to do with the money you save.

There are a few different options for what you can do with the money you save from the no-spend month. You can use it to pay off debt, save for a rainy day, or invest.

You can also use the money to reward yourself for completing the challenge with a fun activity or purchase.

The no spend challenge guide #1. Payoff Student Loans

If you’re burdened with student loan debt, the No Spend Challenge is a great way to get started on paying it off. Any extra money you have at the end of the month can be put towards your loans, which will help you get out of debt faster.

The no spend challenge guide #2. Save for a rainy day

If you don’t have any debt, the No Spend Challenge is a great opportunity to start saving for a rainy day. You never know when you might need some extra money in case of an emergency.

By setting aside a small amount of money each month, you’ll be able to build up your savings over time.

The no spend challenge guide #3. Invest the money

Another option for what to do with the money you save from the No Spend Challenge is to invest it. This can be a great way to grow your money and make it work for you. There are a number of different investment options available, so be sure to do your research and find the one that’s best for you.

The no spend challenge guide #4. Payoff Credit Cards

If you’re struggling with credit card debt, the No Spend Challenge is a great way to get started on paying it off. Any extra money you have at the end of the month can be put towards your credit cards, which will help you get out of debt faster.

The no spend challenge guide #5. Save for a specific goal

If you have a specific goal in mind, the No Spend Challenge is a great opportunity to start saving for it. Whether you’re looking to save for a new car or a down payment on a house, the Challenge can help you get there.

The no spend challenge guide #6. Use the money to reward yourself

Finally, another option for what to do with the money you save is to use it to reward yourself for completing the challenge. This can be a fun way to celebrate your success and enjoy

The no spend challenge guide #7. Donate to Charity

One of the most rewarding things you can do with the money you save from the No Spend Challenge is to donate it to charity. This is a great way to give back and make a difference in the world.

The no spend challenge guide #8. Invest in Education

If you’re looking to invest in your future, the money you save from the No Spend Challenge is a great option. You can use it to invest in your education, whether it’s through books, courses, or other resources.

The no spend challenge guide #9. Take a Family Vacation

One of the best ways to use the money you save from the No Spend Challenge is to take a family vacation. This is a great way to spend time together and create memories that will last a lifetime.

The choice is yours!

No spend months are becoming increasingly popular as people look for ways to save money and reduce their debt.

If you’re considering doing a no-spend month, the first step is to decide how long you want to do the challenge. It’s generally recommended that you start with a shorter challenge (like a week or a month) and then work your way up to longer periods of time.

So what are you waiting for? Start the No Spend Challenge today and watch your savings grow!

People also ask

How do you do a no-spend challenge?

Answer: There are a few different ways to do a no spend challenge, but the basic idea is to not spend any money for a set period of time. This can be a great way to get your finances in order and save money for the future.

How long should the no spend challenge last?

Answer: The length of the no spend challenge will vary depending on your goals and how much money you want to save. It’s generally recommended that you start with a shorter challenge (like a week or a month) and then work your way up to longer periods of time.

What is a No Spend Challenge?

Answer: A no-spend challenge is a great way to get your finances in order and save money for the future. It involves not spending any money for a set period of time, which can be a great way to reduce your debt and build up your savings.

There are a few different ways to do a no-spend challenge, but the basic idea is to not spend any money for a set period of time.

How do you challenge yourself to not spend money?

Answer: There are a few different ways to do the no spend challenge, but the basic idea is to not spend any money for a set period of time. You can challenge yourself to not spend money for a week, a month, or even longer.

How do I get ready for no spending month?

Answer: There are a few things you can do to get ready for the no-spend month. First, create a budget so that you know how much money you have available each month.

This will help you better allocate your funds and make sure that you’re not spending more than you can afford.

Second, set financial goals to help you stay motivated and on track with your spending. Finally, involve your family and friends to make the challenge more fun and keep you accountable.

What are the benefits of a no spend month?

Answer: There are many benefits to doing a no spend month. First, it can help you get your finances in order by reducing your debt and building up your savings. Second, it can help you become more mindful of your spending habits.

Finally, it can be a great way to bond with family and friends as you work together to accomplish the challenge.

More Reading – How to Save $10,000 in 6 months

Final Thought – The No Spend Challenge Guide

Pin it! 😎

The no-spend challenge is a great way to get out of debt and save money. With a little planning and discipline, you can successfully complete the challenge and achieve your financial goals!

By following the tips in this guide, you’ll be on your way to financial freedom in no time! So what are you waiting for? Start the challenge today and see amazing results!

Over to You

Have you ever completed the no spend challenge? What tips do you have for success? Share in the comments below!

Start the conversation by commenting on the blog post:

Latest Articles

- Why is Personal Finance Dependent Upon Your Behavior?

- Hosting an Online Garage Sale: Go from Clutter to Cash now

- 11+Cheap(or Free) things to do in retirement: Do more with less!

- Coast FIRE: Path to Financial Independence with Less Sacrifice

- Cash Stuffing Method: The Ultimate Financial Hack You Need to Know